Business Organization

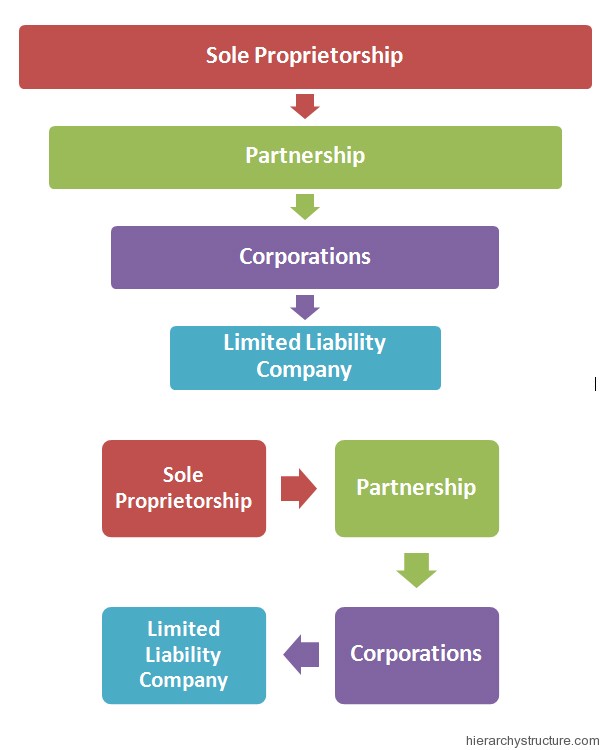

Business Structuring and Organization Leading to Business Legal Incorporation or LLC formation

At ECJ, we have found that an empowered and passion filled person or business is a client that will tend to stay within the ECJ Family for many years. To help you achieve that endeavor, our team from the minute we began conversation with you strive to help you educate, empower and maximize your time, effort and energy in whatever you choose to do.

At ECJ, we have found that an empowered and passion filled person or business is a client that will tend to stay within the ECJ Family for many years. To help you achieve that endeavor, our team from the minute we began conversation with you strive to help you educate, empower and maximize your time, effort and energy in whatever you choose to do.

We strive to apply this same principle as it relates to business formation and Corporate/LLC formation. Our team does this by employing a 3 step approach to your individual empire.

Step #1 – Discuss the pros and cons of the major types of entity structures

Step #2 – Discuss the pros and cons of the legal structure “AND” Tax structure. This is especially true now in light of the new tax code which has to be examined more than ever during this step

And

Step #3 – Discuss how the new entity structure will impact your current tax and wealth picture. For example, under the new tax code, C Corporation structures may have become popular again in certain circumstances due to changes in overall tax rates.

Historically, unfortunately, many clients have 1st come to us just embarking on Step 1 and maybe Step 2 but rarely Step 3, many of them thinking that they hit a home run when in reality it was only a single or double.

Let our firm help you to hit a home run and over time strive to hit a GRAND SLAM!!